how are property taxes calculated in lee county florida

Unrecorded Plats and Maps. After the assessor deducts the SOH assessment from a propertys just value to arrive at its assessed value the tax collector calculates a propertys taxable value after also.

Lee County Florida United States Of America

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments.

. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non-ad valorem. 104 of home value Yearly median tax in Lee County The median property tax in Lee County Florida is 2197 per. Ad valorem taxes are based on the value of property.

Historically tax rates have fluctuated within a fairly. Fort Myers Florida 33901. Tax Deed and Foreclosure Sale Processes.

An appraiser from the countys office estimates your propertys worth. To pay back taxes and fees to cancel a sale please follow the instructions on. The median property tax also known as real estate tax in Lee County is 219700 per year based on a median home value of 21060000 and a median effective property tax rate of.

Please note that we can. An assessor from the countys office establishes your propertys market value. Courts Foreclosure Tax Deed Sales.

Official Records Deeds Mortgages Easements Liens Maps Plats. Our Lee County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Sales dates times auctions document search and payment options.

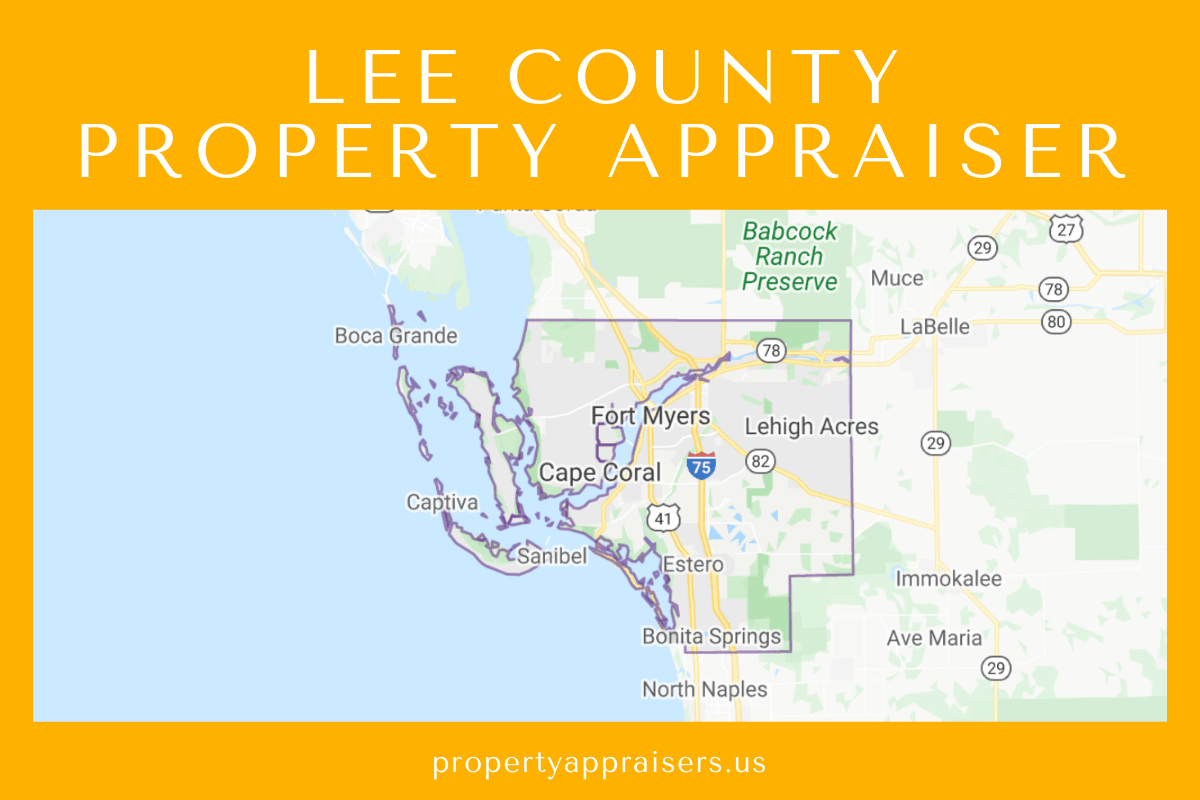

If you have already applied for Homestead Exemption but not portability be sure to complete the application and return it to the Lee County Property. The actual tax rate used to calculate property taxes is set every year by the various taxing authorities in Lee County. Lee County Property Appraiser.

Get driving directions to this office. Florida Statute 197162 offers taxpayers a discount paying their taxes early. That amount is multiplied by the established tax levy which is the total of all applicable governmental taxing.

239 533 6100 Phone 239 533 6160 Fax The Lee County Tax Assessors Office is located in Fort Myers Florida. 2480 Thompson Street 4th Floor. Lee County Florida Property Tax Go To Different County 219700 Avg.

A reassessed market value is then multiplied times a total rate from all taxing entities together to determine tax bills. 4 if paid in November 3 if paid. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Taxes become delinquent on April 1 at which time additional charges will apply.

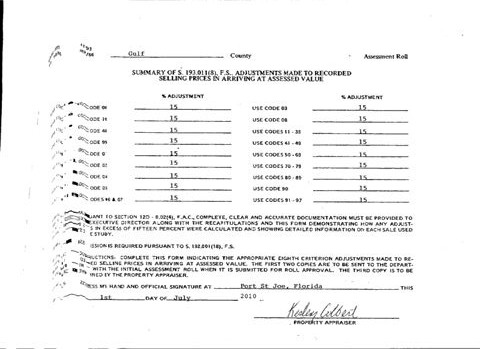

Florida Dept Of Revenue Property Tax Data Portal

Florida Real Estate Taxes And Their Implications

Your Guide To Prorated Taxes In A Real Estate Transaction

Region S Property Tax Dollars Go Far For Some Counties Business Observer Business Observer

Lee County Fl Real Estate Lee County Fl Homes For Sale Zillow

140 Florida Legal Ideas In 2022 Florida Being A Landlord Legal

Online Parcel Inquiry Lee County Property Appraiser

Florida Dept Of Revenue Property Tax Data Portal

The Cost Of Buying And Owning A Property

Property Values Are Up So What About Taxes Florida Realtors

With Save Our Homes Homeowners Savings Are Governments Loss

Property Taxes Calculating State Differences How To Pay

Florida Property Tax Calculator Smartasset

Lee County Property Appraiser How To Check Your Property S Value

With Save Our Homes Homeowners Savings Are Governments Loss

Lee County Fl Property Tax Search And Records Propertyshark

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center